Gregory Heym is Chief Economist at Brown Harris Stevens. His weekly series, The Line, covers new developments to the economy, including trends and forecasts. Read on for the latest report and subscribe here to receive The Line in your inbox.

Today, we present the latest on economic growth.

The U.S. Economy Grew at a 1.1% Pace in 1Q23

Gross domestic product, the value of all goods and services produced in the U.S., rose at a 1.1% annual rate in the first quarter. With all the recession talk out there, this may sound like a great result, but it was actually lower than the 2% growth economists were expecting. So, you should look at this as good, but not great news.

Let’s get into the specifics of the report. You may remember the formula for GDP is:

GDP = C + I + G + (X – M)

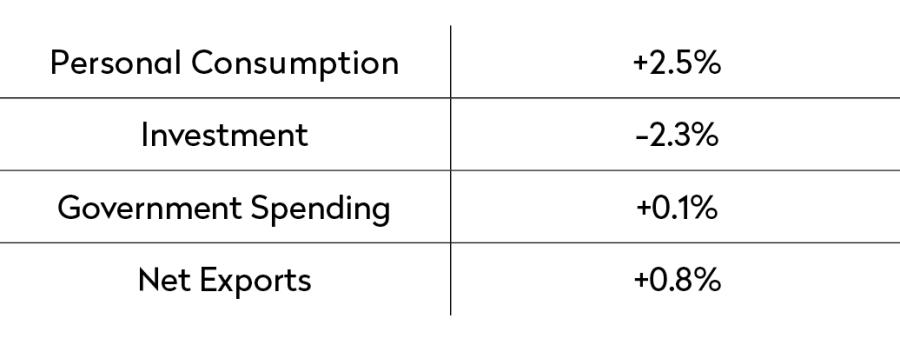

Here’s each category’s contribution to economic growth in 1Q23:

Add that all up, and you get 1.1%. I won’t get offended if you check my math.

Since it accounts for roughly 70% of GDP, personal consumption—otherwise known as the stuff you and I buy—is always the most important piece of the GDP puzzle. Consumption rose at a 3.7% annual rate in the first quarter, which sounds good, but a closer look at recent data tells us not to be so happy.

You may remember that in last week’s column I mentioned that retail sales surged in January, helped by better-than-expected weather and a steep increase in social security payments. That’s the sole reason the consumption number was so strong, as sales fell in February and March. So, while the 1Q23 data on spending was positive, the most recent data tells us to expect a much weaker number next quarter.

One big change in the first quarter was the 12.5% decline in investment, which subtracted 2.3% from the overall GDP figure. In my column about 4Q22 GDP, I pointed out that almost half the growth that quarter was due to investment, and more specifically a buildup in inventories that wouldn’t last. Well, it didn’t last, and we should expect investment to continue to be a drag on growth in the coming quarters.

One thing to remember about GDP data is that there can be quarters where temporary factors can skew the data. It sounds a lot like Manhattan apartment sales reports, where a few super luxury, high-end new development sales can make the market look a lot better than it really is.

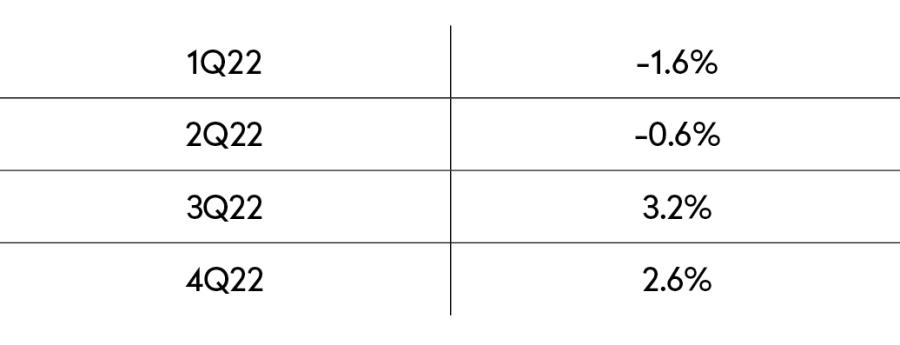

Here are the GDP figures for the previous four quarters:

The negative numbers in the first two quarters of 2022 were not due to a decline in consumer spending, which rose in both quarters. It was a sharp decrease in net exports in 1Q22, and a 14.1% plunge in inventories in 2Q22 that pushed those GDP numbers negative. Net exports turned positive in the third quarter of 2022, which combined with an increase in government spending helped the GDP rise 3.2%. As I said earlier, a buildup of inventories helped the 4Q22 number rise 2.6%, even though consumer spending increased by only a 1.0% rate.

My advice is not to look at the headline GDP number, but at the rate of growth in each category. Using the old definition of a recession—two straight quarters of negative GDP growth—we would have been in recession the first half of last year. But how could that be true if consumer spending rose in each of those quarters, and the labor market was booming? Sorry if this is a bit too nerdish, but every now and then that side of me has to come out and play!

To sum up, this report does nothing to change my opinion that a recession is coming later this year. Yes, there still are good things happening in the economy, most notably in the labor market. But that doesn’t cancel out the fact that:

- Consumer spending is declining and confidence is at a nine-month low

- Inflation is still high enough for at least one more Fed hike

- The housing market remains sluggish

- There is the potential for more bank failures

That said, don’t panic too much, as it is that great labor market that will keep the recession mild and short-lived.

You can read the full 1Q23 GDP report at this link.